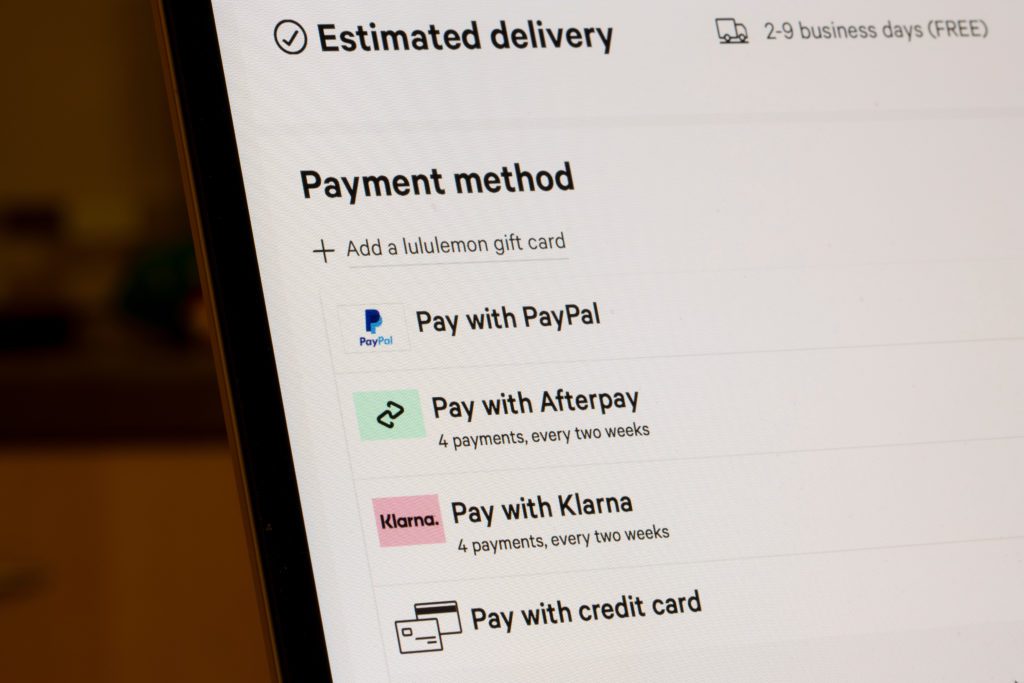

After the watchdog identified potentially unclear terms and conditions, some buy now, pay later customers could get refunded.

Customers who were charged late payment fees by Clearpay, Laybuy, and Openpay will receive a refund voluntarily in specific circumstances.

The Financial Conduct Authority (FCA) asked firms offering buy now, pay later to be more clear with their terms.

As a result of some firms’ terms being drafted, there was a potential risk of harm to consumers, the FCA said.

Clearpay, Klarna, Laybuy, and Openpay are all cooperating fully with the FCA’s investigation, according to the regulator

Companies will now make contract cancellations and payments easier to understand.

Additionally, one of the terms involved late payment fees has led to Clearpay, Laybuy, and Openpay agreeing to voluntarily refund customers who have been charged late payment fees in certain circumstances, the FCA said.

“Buy now, pay later has grown exponentially,” said Sheldon Mills, FCA executive director of consumers and competition.

“We do not yet have powers to regulate these firms, but we do have powers to review the terms and conditions of consumer contracts for fairness, and have acted proactively to ensure that the BNPL industry adopts high standards in their terms and conditions”

“The four BNPL firms we have worked with have all voluntarily agreed to change their approach. We welcome this and hope that the rest of the industry will now follow.”

The terms and conditions of Clearpay, Klarna, Laybuy, and Openpay will be changed.

Three of the firms – Clearpay, Laybuy, and Openpay – have agreed to refund affected customers.

Potentially affected customers are those who cancelled their entire order and were charged a late fee after the loan agreement should have been cancelled.

There are no late payment fees charged by Klarna, so customers do not have to give a refund.

As soon as Clearpay realizes there are affected customers, it will contact them to arrange an automatic refund.

Anyone who may be affected by this can request a refund through the BNPL provider’s website.

You will need to provide basic information like your name, date of birth, contact information, and order number.

If customers returned all items but had to wait longer for a refund from the shop they bought from, they could have been charged a £6 late fee.

A Clearpay spokesperson stated that there may be a “very small group of customers who may have incorrectly been charged a late fee because we were not notified of them returning a purchase within a certain time frame.”

With “Pause and Notify”, you can delay your payment up to two weeks for free while you wait for the retailer to issue a refund.

In an inquiry to Laybuy, and Openpay, the Sun asked who would receive refunds, and if customers would have to make a claim or would get the cash automatically, and we’ll update when we hear back.

According to the company, Laybuy has streamlined its contract terms, including how to cancel or return orders.

Those who believe they may have been affected should contact BNPL directly in the first instance.