The Impact of COVID-19 on the UK’s Web Design and Creative Sector

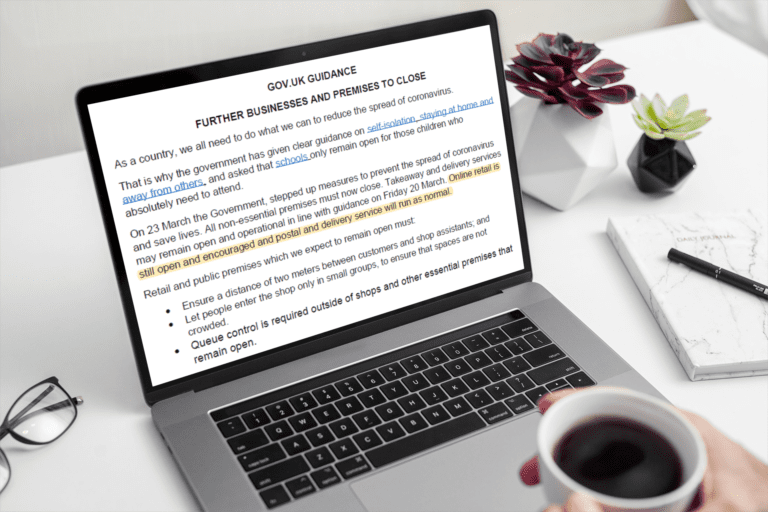

The onset of COVID-19, a global health crisis unlike any in recent history, has left an indelible mark on industries worldwide, including the UK’s website design and creative media sector. The pandemic’s restrictions necessitated a rapid shift to online platforms, catalysing a digital revolution.